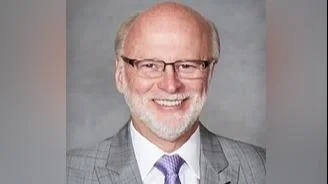

Contributed photo

Contributed photo

Illinois may be in even bigger financial trouble than what official projections have suggested.

The projected budget deficit of $7.1 billion may be only half the total when accounting for the money needed to keep the state's unfunded pension liability, the backlog of unpaid bills and various other expenses from growing.

State Sen. Jim Oberweis (R-Sugar Grove) said the problem is that the state spends more than it takes in.

“Our rate of spending over our income is approximately $3 billion to $4 billion right now,” Oberweis told the Sangamon Sun.

A large portion of the state's financial burden comes from its backlog of unpaid bills, which some estimates have said could reach $13 billion by the end of the fiscal year in a little over six months.

“It is approximately $8 billion right now,” Oberweis said. “I don’t think a $12 billion estimate is necessarily wrong. Something in the area of $12 billion to $13 billion is certainly possible. Part of that depends on what happens -- whether we can pass a budget, whether the governor is able to implement his last and best offer to AFSCME (American Federation of State, County and Municipal Employees). There are a lot of things to affect that.”

Oberweis said that to reduce the bill backlog and other elements in the fiscal liability mix, the state needs budget discipline.

“We need to drastically reduce our spending and the only way to do that is to pass a budget,” Oberweis said. “Right now, the court is ordering us to continue to spend at basically 2015 levels, and that is making the deficit worse. We need to pass a balanced budget.”

Oberweis said Illinois may see a temporary tax increase, something that has scared away many residents and businesses.

“There is certainly going to be some impetus for a tax increase,” Oberweis said. “I think there is a reasonable likelihood that the governor would go along with a tax increase if, and only if, House Speaker Michael Madigan (D-Chicago) agrees to accept some of the absolutely necessary common-sense reforms that the governor has proposed so that we can send a message to the business community that things are changing in Illinois and things will get better in Illinois.”

Oberweis said that out of the five reforms Gov. Bruce Rauner has discussed, he said passing workers' compensation reform and term limits for legislators would be the only possible way to make any tax increases more palatable.

“I think that raising taxes will be a disaster for the state and will accelerate the exodus of jobs, businesses and people from Illinois unless it is coupled with the common-sense reforms that the governor has proposed,” Oberweis said. “If we pass those reforms, then I think people and businesses would be more willing to accept -- at least -- a temporary tax increase.”

Regarding the massive pension liability, Oberweis said the state needs to move away from the traditional defined-benefit pension system.

“We desperately need to make pension adjustments or changes,” Oberweis said. “The right answer would be to end any future defined-benefit pension and move to a defined-contribution system, such as a 401(k), so that we are funding those on an ongoing basis instead of postponing those liabilities. That would be challenging to do in the short run, but it would absolutely be the right thing to do in the long run.”

Oberweis said the state’s financial predicament can be traced back to one man: Madigan.

“I believe that Mike Madigan is a power-hungry individual who has been in control of the state or 30 years and has made horrible mistakes for the state of Illinois, resulting in disastrous financial conditions, and yet he continues to (block) the governor’s reforms that will help make the state better,” Oberweis said. “I believe this is 100 percent the fault of Mike Madigan. If Madigan would accept the reforms the governor has proposed, I believe we would have a budget very quickly, we would send (a message) to the business community that we want you, we want the jobs, that we have an opportunity to make Illinois better.”

Alerts Sign-up

Alerts Sign-up